Risky, But Not Yet "Toppy"

Is the market on shaky ground, or does it still have room to run? In Risky, But Not Yet 'Toppy', Doug Ramsey breaks down the market’s resilience, the influence of top earners on consumer spending, and the latest signals from technical indicators. With inflation pressures persisting and valuations still high, this webinar offers key insights into where investors should focus next.

Perilous, But Not 'Peaky'

Are we on the verge of an economic downturn, or is the market poised for further growth? Join us as Doug Ramsey, Chief Investment Officer at Leuthold, shares his insights on the current economic landscape and market trends.

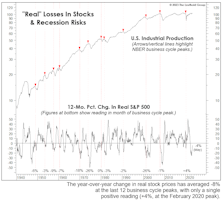

Watching The Wealth Effect

“Real” stock-market wealth has declined considerably since late 2021 without yet delivering a knockout blow. But if the other key evidence detailed throughout this section is on the mark, that wallop is lurking in the very near future.

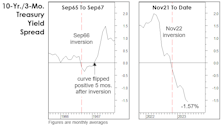

Revisiting The 1966 Forecast Failure

Developments over the last four months leave us even more skeptical that the November yield-curve inversion will join 1966 as a “false positive.” The number one reason being the subsequent shift in the yield curve itself.

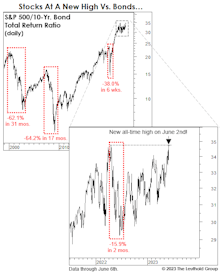

Stocks Versus “Safe Havens”

While we aren’t clamoring to add long-term Treasuries in tactical accounts, we believe that the past 18-months’ action has left them more attractive versus stocks than during most of the last 15 years. However, compared to gold, the S&P 500 still trails on a total return basis measured back to Y2K.

Youthful Rally Already Looks Old

For more than a year, we’ve characterized the U.S. economy and policymakers’ decisions as increasingly late-cycle in nature, but that probably doesn’t do justice to the U-turn in the investment backdrop.

Earnings Momentum - Still Flashing Recession

Our latest Up/Down ratio is 1.07. As we’ve mentioned in the past, the four previous periods in which the ratio dropped this low were all accompanied by recessions. However, the runways of poor figures leading to prior recessions has never been as long as the current one.

S&P 500 Earnings Waterfall 1Q 2023

This note continues our practice of summarizing the latest earnings season by analyzing the composite results of the S&P 500 member companies, as if the SPY ETF represented a share in a single company with 500 subsidiaries.

In Memoriam Steve Leuthold

Steve Leuthold, a nationally respected investment strategist known for his contrarian nature and unpretentious style, passed away peacefully at his home in Carlsbad, CA, on March 7, 2023, at the age of 85.

Whittled Down by Pinched Margins

Our Up/Down ratio reads 1.27. That is noticeably higher than the other three “two-month” figures of 2022, but still well below the historical average. Given the dour direction of reported- and estimated earnings, it’s a bit surprising that we’re seeing even a small pop in the results.

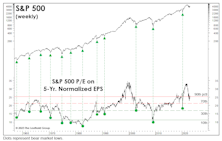

Valuations: What Bear Market?

If the October S&P 500 low holds, the normalized P/E ratio of 22.7x on that date will signify the priciest bear market bottom in history; in fact, it is exactly the same level reached as at the August-1987 bull market high. Since October, the normalized P/E multiple has grown to 25.5x—higher than all but three previous bull market peaks.

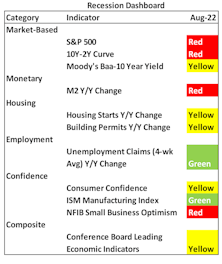

Recession Dashboard Update—Real Recession More Likely Than Not

Our recession indicators have continued to deteriorate. Given the stagflation backdrop, the Fed’s tightening cycle is very likely to end in a recession.

Yield Curve Inversion—Count Down To A Bull Steepener

Now that the yield curve has inverted, its dynamic is apt to change from bear flattening (higher rates, flatter curves) to bull steepening (lower rates, steeper curves) fairly soon.

Bond Yields: Cyclical Pressures Vs. Positioning

Even after watershed events COVID-19 and MMT, some things never change.

Next year will begin like almost every one of the past dozen years, with economists and strategists expecting bond yields to rise.

Unlike most of those years, though, there are several measures of “cyclical pressures” that would seem to give them a good chance of being right. The best-known among these might be the “Copper/Gold Ratio,” popularized by DoubleLine’s Jeffrey Gundlach, which suggests 10-Yr. Treasury yields should be around double their current level (Chart 1).

The Rotation Should Hardly Be A “Surprise”

Consumer Price Inflation of 1.2% for the twelve months through October remains way below the Fed’s long-time 2% objective, which is nothing new. But a first step in getting inflation to eventually run a little bit “hot” (the Fed’s new objective) is to break the long-term disinflationary psychology among consumers and investors, and that is clearly happening. In fact, based on the excellent “Inflation Surprise” Indexes published monthly by Citi, the U.S. is now the world’s inflationary hotspot!

Momentum’s Terrible, Horrible, No Good, Very Bad Day!

If Momentum and Growth investors thought they were escaping 2020 unscathed, they learned otherwise on Monday. Pfizer’s promising news about a COVID-19 vaccine was met with universal excitement and investors rearranging portfolios—taking gains in long-term winners and plowing into beaten-down cyclical stocks.

Research Preview: A Surprising Dividend Study

Dividends are a cornerstone of equity investing and, over the decades, they have produced a significant portion of the stock market’s total return. Previous Leuthold research has identified a strong dividend influence on total returns for small and mid-caps; a client recently asked if we found the same effect in the universe of S&P 500 companies. Specifically, have S&P 500 dividend-payers outperformed non-payers, and, second, have dividend growers outperformed non-growers?

It’s Time To Choose

Which box do you check? The “status quo” or the “change of pace?” Keep in mind, the same decision in front of you turned out to be extraordinarily important four years ago. So, which will it be for 2020 and beyond? Large Cap Growth or Small Cap Value?

Election—Another Chance For Value

As we Chinese watch the elegant display of the western democratic process this election season, we can’t help but think there are indeed people less fortunate than us “commies.” Worse yet, some of these people are Value investors.

Leuthold Factor Tilt Update

Factor analysis is a point of emphasis in Leuthold’s tactical research activities, and this note summarizes our Factor Tilt outlook going into the fourth quarter. Factors are return drivers such as Value, Momentum, and Quality, and research has found that factor results vary over time—but that does not mean they are random.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)